Dying without a Will is both the easy option and, likely, the worst possible one..

Typically, the deceased couldn’t be arsed to have a valid Will drawn-up, or didn’t realise the issues and implications they imposed on those they leave behind

All the information you need is listed below but, first, take a look some other perspectives:

You’re in good company

There’s a surprising number of public figures who didn’t get around to sorting their Wills, or chose not to. Google provides a long list, including:

- James Brown

- Kurt Cobain

- Jimmy Hendrix

- Howard Hughes

- Martin Luther King

- Abraham Lincoln

- Bob Marley

- Amy Winehouse

- Barry White

There are even celebrities cutting their kids from their Wills

Some people make the conscious decision to exclude their children. Not right, not wrong, just different. Here’s some examples:

John Lennon

Is survived by two sons, Sean with wife 2 Yoko Ono and Julian with wife 1 Cynthia. His $264m fortune was bequeathed to Yoko, and to Sean, when he died. His eldest son Julian was left nothing and sued Lennon’s estate in 1996. After a lengthy court battle, Julian won around £20m

Gordon Ramsey

The restaurateur and TV personality has stated that he “won’t spoil his children too much”. His children “rarely eat in his Michelin-starred restaurants” and they “do not sit with their parents in first-class when they are flying on holiday”

Ramsey stated that he has no plans to leave everything to his children in his Will, saying “It’s definitely not going to them. That’s not in a mean way, it’s to not spoil them”

Sting

Sting said back in 2014: “I certainly don’t want to leave them trust funds that are albatrosses round their necks. They have to work. All my kids know that, and they rarely ask me for anything, which I really respect and appreciate”

Marie Osman

US country singer Marie Osman says none of her 8 children will be receiving an inheritance from her $20m estate. ‘It’s not malicious, it’s just that I want them to find their own success’

“Honestly, why would you enable your child to not try to be something? I don’t know anybody who becomes anything if they’re just handed money” she told WS Weekly

Daniel Craig

Does not plan to leave his multi-million-pound fortune to his children saying he “would prefer to donate his money to charity or spending it on good causes”. He has previously said that he finds the idea of inheritance ‘distasteful’ and that his 2 children will not be getting his $125m fortune

“My philosophy is to get rid of it or give it away before I go” Craig said

It’s different for the rest of us…

The rich and famous have a different playbook, of course, and most of us live in a different world. Let’s move on to the very real issues and implications which everyone needs to consider…

Wills, Intestacy and Statutory Rights

Dying without a Will is the default position for lots of people. Thirty+ years of real-life experience suggests that’s because they didn’t realise what impact their decision has on their family and loved-ones

You need to make your Will and you need to do it right away. Don’t put it off. One day it will be too late, and it’s not just for Inheritance Tax planning reasons (though those are usually compelling for wealthy people!)

What happens to your money, property and possessions if you die without a valid Will?

Your estate will be subject to the Laws of Intestacy and those probably don’t do what you think they do, or should, and you probably won’t like them

More importantly, your Will is essential for nominating the future guardians of your children

What is Intestacy?

‘Intestacy’ occurs where a person dies without leaving a valid Will, and therefore dies ‘Intestate’

The order of priority on Intestacy is set out in Section 48 of the Administration of Estates Act 1925 (AEA 1925), as amended. The rules in relation to a surviving Spouse changed significantly following the Inheritance and Trustees’ Powers Act 2014 (ITPA 2014)

What is the order of Beneficiaries according to the rules of Intestacy?

This part is heavy going, but is really important. Read on, McDuff..

If you leave a Spouse and Children

Legislation refers to Children as ‘Issue’ but that’s such an ugly term, so we’ll refer to ‘Children’

The first £270,000 and all personal possessions go to the surviving Spouse. 50% of the balance is divided equally among the Children. The other 50% is held on ‘Trust’ with the surviving Spouse having a life interest. This passes to the Children when the surviving Spouse dies

If you leave a Spouse and no Children

If you have no surviving Parents, Siblings (Sisters and Brothers), Nieces or Nephews, then your entire Estate passes to the surviving Spouse

Otherwise, the surviving Spouse is restricted to £450,000 plus all Personal Possessions and 50% of the remaining balance

The other 50% goes to Parents, if they survive you. It goes to your Siblings if both Parents are dead. It goes to your Nieces and Nephews if both Parents and all Siblings are dead

If you leave Children but no Spouse

Your Estate is divided equally among your Children

If you leave no Spouse or Children

Your Estate goes to your nearest Relatives to survive you, in this order:

Your Parents first. If both are dead, then to your Siblings. If your Siblings are all dead, then to their Children

If no Relatives survive you

It all goes to the Crown..!!

‘Is that what you want, ‘cause that’s what’ll happen’ Harry Enfield

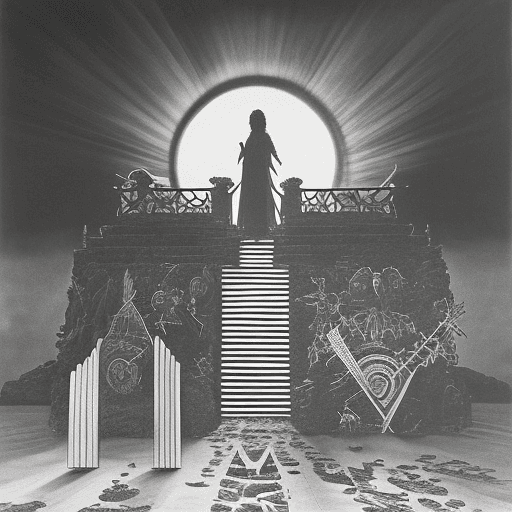

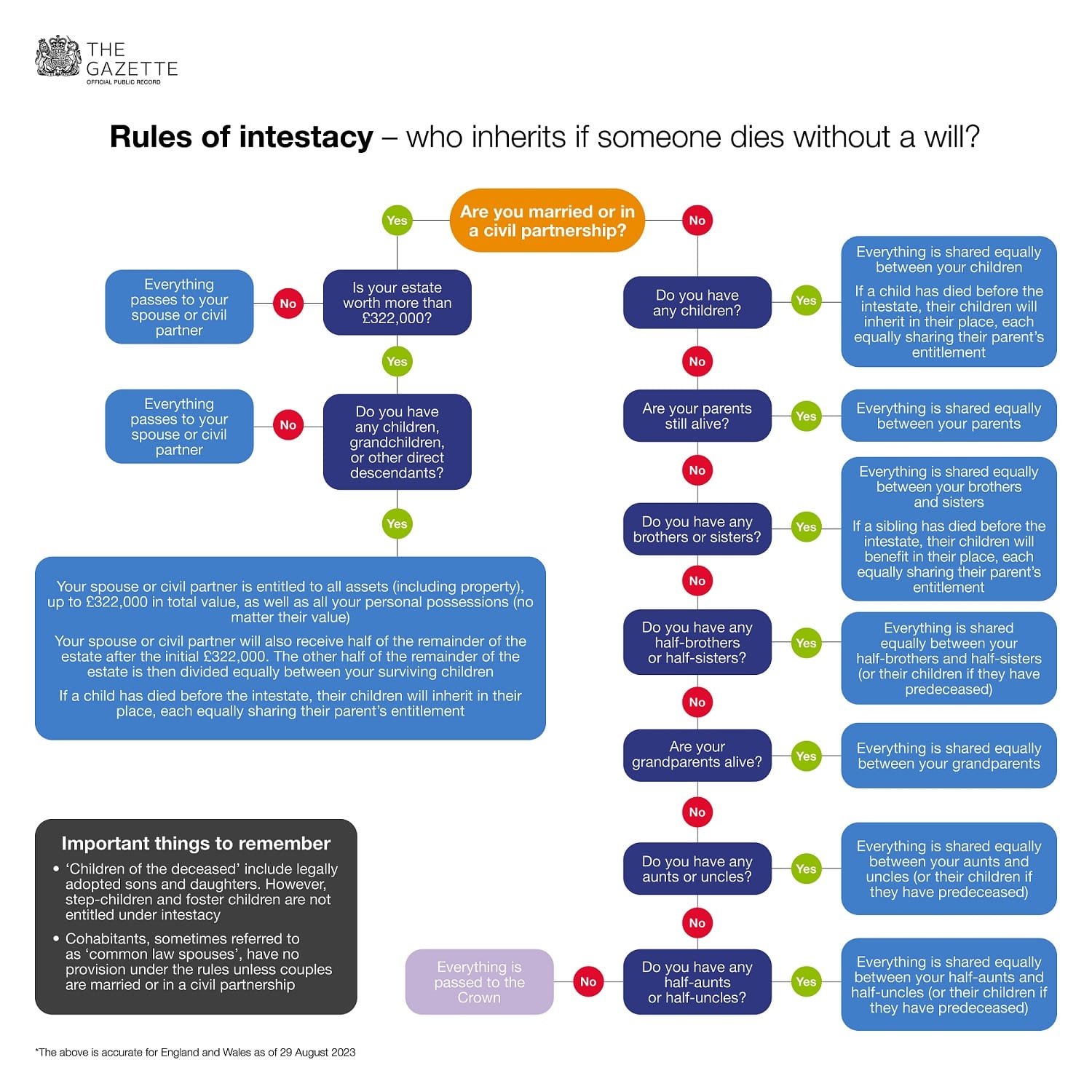

Rules of Intestacy in England & Wales – here’s a helpful diagram:

Dying without a valid Will in Scotland

The rules are different in Scotland, and here’s how:

If you leave a Spouse and Children

The surviving Spouse gets your interest in your Family Home up to £300,000

If the Family Home exceeds £300,000 the surviving Spouse gets the right to ‘Receive the sum of £300,000, plus Personal Possessions up to the value of £24,000, plus the first £42,000 of the Remaining Estate, and one-third of any other ‘Moveable Property’ (anything OTHER than land and buildings!)

The Children get the remainder of your Estate

If you leave a Spouse and no Children

The Surviving Spouse gets your interests as above, plus the first £75,000 from the Remaining Estate and half of any other Moveable Property

Everything else falls into you ‘Free Estate’, described below

If you leave Children but no Spouse

Your entire Estate is divided equally among your Children

If no Relatives survive you

Your Entire Estate is dealt with under Rules for a Free Estate

Free Estate

This is the remainder of the Estate after Funeral Expenses, Debts, and Prior and Legal Rights have been settled. The order of those entitled is set out in detail in the Succession Scotland Act 1964 (as amended)

Rules of Intestacy in Scotland – here’s a helpful diagram:

Sunsetting your old thinking.!

Here’s some very important reasons to go make your Will:

- Without proper provision, your Children could be taken into care..

- Intestacy Rules could force your Spouse to sell your Family Home

- There’s no provision for Common-Law Partners

- There’s no provision for Step-Children..

Finally, and perhaps worst of all, the hereditary billionaires who form the British Monarchy, could get your family home in preference to your common-law partner – and the Monarchy doesn’t even pay Inheritance Tax!

On 11th February 1993, John Major, as Prime Minister, removed the Monarchy from the scope of Inheritance Tax. Neither King Charles III, nor any members of the family, including Prince William were required to pay tax on their inheritances from Queen Elizabeth II

For those who believe in coincidences, John Major was knighted by Queen Elizabeth in 2005, and was a guest at most major royal events since..

Hey ho, just saying..

How to get your Will and Inheritance Tax planning sorted and kept up to date

We work closely with legal professionals who will be pleased to help you sort your Will. Jump on the link below if you’d like an introduction

Then, the next step is to sort your Inheritance Tax planning. The UK has one of the most complex tax structures in the world, with around 18,000 pages of tax laws, and nearly 1,000 tax reliefs and allowances. You can’t know them all. That’s a job for our team of Chartered Tax Advisors (CTA’s)

At outset, we ask you to visualise the future you want for your family legacy then, with our help, work back to today, using informed choices. Our CTA’s provide you with your legacy planning strategy, and all the tools you need to realise your vision

Once your Inheritance Tax planning is finalised, and paid for, you may be invited to become a full member of our Resource Optimisation Program (ROP) where our CTA’s will continue to work with you to aim to maintain everything for you while you’re alive, and they’ll even handle probate for your beneficiaries when you die, if that’s what you want..

ROP provides you with 3 options: our CTA’s will implement, maintain and manage everything, or our CTA’s will work with your existing advisors, or you can do it all yourself. That’s ‘Done for you’, ‘Done with you’ or ‘Done by you’

Contact us HERE to talk to an expert, for FREE